Hotel, Housing and More Proposed for Howell Mill Road

Hotel, Housing and More Proposed for Howell Mill Road

A mixed-use project proposed for West Midtown would create three buildings of residential and commercial space.

The project referred to as “981 Howell Mill Mixed-Use Development” in documents would include three buildings with “multifamily residential, commercial and hotel uses,” according to a recent Developments of Regional Impact (DRI) filing. The development could be nearly 1.1 million square feet, according to the filing.

The team behind the filing is ANiMAL, an Atlanta-based real estate firm and joint development partner in the Star Metals District with the Allen Morris Company. According to the firm, they purchased the site in March 2020 at a price of $11 million. The site was formerly occupied by the Atlanta Human Society complex.

According to ANiMAL, the project “breaks the mold by prioritizing cutting-edge urban design and public green space.”

The mixed-use development has an estimated completion date of 2030, according to the DRI filing.

Keep up with What Now Atlanta’s restaurant, retail, and real estate scoop by subscribing to our newsletter, liking us on Facebook, and following us on Twitter. Opening a restaurant? Browse our Preferred Partners.

Real Estate, 981 Howell Mill, Allen Morris Company, ANiMAL, Star Metals District, west midtown The mixed-use project at the former Atlanta Humane Society complex would include three buildings. Read MoreWhat Now AtlantaReal Estate – What Now Atlanta

The mixed-use project at the former Atlanta Humane Society complex would include three buildings.

Branch Properties Greenlighted for Gainesville Town Center

Branch Properties Greenlighted for Gainesville Town Center

Branch Properties received unanimous rezoning approval from the City of Gainesville for Lakeshore, the 49-acre mixed-use redevelopment of Lakeshore Mall. Branch Properties will break ground on Lakeshore in late 2026, and completion is anticipated in 2028. Positioned between Lake Lanier and Interstate 985, Lakeshore is anticipated to become Gainesville’s premier town center. Gainesville is a town of just over 40,000 residents NE of Atlanta.

At full buildout, Lakeshore will feature 305,444 square feet of retail space, 652 multifamily residential units and 38,200 square feet of outdoor community greenspace. The redevelopment will also include capacity for a hotel and townhomes in future phases. Anchors Dick’s Sporting Goods and Belk will remain open throughout the transformation, with Dick’s Sporting Goods relocating within the property. Franklin Street’s Len Erickson will work in tandem with Branch Properties on the retail leasing.

The post Branch Properties Greenlighted for Gainesville Town Center appeared first on Connect CRE.

Branch Properties received unanimous rezoning approval from the City of Gainesville for Lakeshore, the 49-acre mixed-use redevelopment of Lakeshore Mall. Branch Properties will break ground on Lakeshore in late 2026, and completion is anticipated in 2028. Positioned between Lake Lanier and Interstate 985, Lakeshore is anticipated to become Gainesville’s premier town center. Gainesville is a town …

The post Branch Properties Greenlighted for Gainesville Town Center appeared first on Connect CRE. Read MoreAtlanta Metro Commercial Real Estate News

Branch Properties received unanimous rezoning approval from the City of Gainesville for Lakeshore, the 49-acre mixed-use redevelopment of Lakeshore Mall. Branch Properties will break ground on Lakeshore in late 2026, and completion is anticipated in 2028. Positioned between Lake Lanier and Interstate 985, Lakeshore is anticipated to become Gainesville’s premier town center. Gainesville is a town …

The post Branch Properties Greenlighted for Gainesville Town Center appeared first on Connect CRE.

Atlanta Office Market on Rebound

Atlanta Office Market on Rebound

A recently released Transwestern Atlanta office report indicates that the sector is showing signs of life.

Absorption: Companies that have kicked the can for the last couple of years are finally starting to make real estate decisions, resulting in the first positive absorption quarter for the Atlanta market in over two years.

Vacancy: Atlanta always carries a high vacancy rate compared to other metros, even in good market conditions. The delivery of three vacant buildings totaling 869,524 SF contributed to an increase in the market’s direct vacancy of 40 basis points or 25%.

Sublease Space: Sublease inventory has declined 4.2% over the last two quarters, with the completion of several large transactions.

Construction: The amount of space under construction has hit a 14-year low (for SF underway), partly due to leasing pessimism and high construction costs.

The post Atlanta Office Market on Rebound appeared first on Connect CRE.

A recently released Transwestern Atlanta office report indicates that the sector is showing signs of life.Absorption: Companies that have kicked the can for the last couple of years are finally starting to make real estate decisions, resulting in the first positive absorption quarter for the Atlanta market in over two years. Vacancy: Atlanta always carries a high …

The post Atlanta Office Market on Rebound appeared first on Connect CRE. Read MoreAtlanta Commercial Real Estate News

A recently released Transwestern Atlanta office report indicates that the sector is showing signs of life.Absorption: Companies that have kicked the can for the last couple of years are finally starting to make real estate decisions, resulting in the first positive absorption quarter for the Atlanta market in over two years. Vacancy: Atlanta always carries a high …

The post Atlanta Office Market on Rebound appeared first on Connect CRE.

Federal spending cuts may leave low-income housing programs in limbo

Federal spending cuts may leave low-income housing programs in limbo

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic.

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic. Read MoreBizjournals.com Feed (2022-04-02 21:43:57)

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic.

Federal spending cuts may leave low-income housing programs in limbo

Federal spending cuts may leave low-income housing programs in limbo

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic.

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic. Read MoreBizjournals.com Feed (2019-09-06 17:16:48)

Housing affordability has emerged as a signature issue across the country, for both renters and homebuyers, especially since the pandemic.

3 neighboring projects spell fresh life for one Hapeville street

3 neighboring projects spell fresh life for one Hapeville street

3 neighboring projects spell fresh life for one Hapeville street

Josh Green

Tue, 02/04/2025 – 15:26

A fresh year is bringing new commercial life and construction to one of the main thoroughfares in growing Hapeville.

About two blocks from Hapeville’s historic main drag, renovations have wrapped for a new brewery, a new restaurant concept has been confirmed, and the development process has kicked off for nearly 60 new townhomes on consecutive parcels in the 3300 block of Dogwood Drive.

The investments continue a years-long growth spurt for the southside ITP city spurred in part by proximity to Atlanta’s airport and the international draw of Porsche’s expanded North American headquarters.

First on the docket, a grand opening is planned from 11 a.m. to 11 p.m. Saturday for Columbus-based Chattabrewchee Southern Brewhouse, which is opening a second brewery location in a remodeled building now known as “The Hangar” at 3361 Dogwood Drive.

That’s where Arches Brewing operated its taproom for eight years, before uprooting to the Atlanta Utility Works complex in nearby East Point last year.

Owned by U.S. military veteran and Delta pilot Beau Neal, The Hangar building has incorporated an aviation theme throughout. It falls within Hapeville’s Arts District Overlay and the Urban Village zoning district, which is designed to encourage a more walkable and cohesive environment.

“A brewery opening in a renovated former brewery space is quite the turnaround story, given the number of breweries closed in Georgia in 2023 [and] 2024,” noted Brett Reichert, Hapeville City Council member at large, in an email.

A recent renovation divided the brewery’s building into three units, and a tapas restaurant is now slated to occupy the middle space, according to Reichert.

Meanwhile, on an assemblage of seven Dogwood Drive lots immediately north of the brewery, construction is underway on another 58 Hapeville townhomes with walkability to downtown shops and eats.

Marietta-based McNeal Development earned city approval last year to construct the townhomes between 3309 and 3345 Dogwood Drive, replacing several older, vacant houses.

The project is covering about 3 acres total, and each of the townhomes will be Build-to-Rent, instead of being for sale.

The least expensive rental option for a two-bedroom unit will be roughly $2,400, according to a presentation by the development team. (The project’s BTR status was a bone of contention among some Hapeville City Council members last spring, requiring Mayor Alan Hallman to break the 2-2 tie.)

The townhome project is scheduled to start delivering in early 2026. (Find more images and context here).

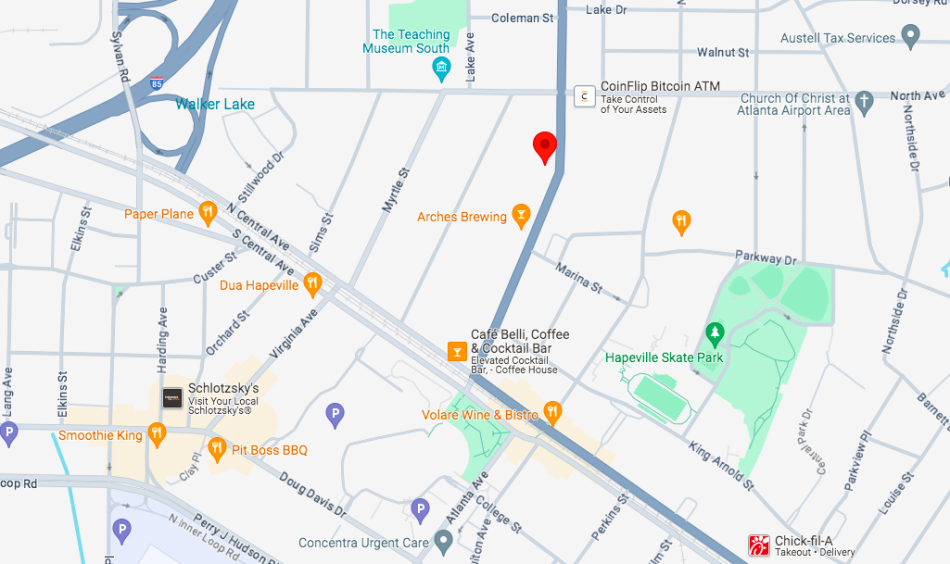

The 3335 Dogwood Drive properties in relation to Arches Brewing and other central Hapeville businesses and landmarks. Google Maps

A few blocks north of that project, on the same side of Dogwood Drive, another 28-unit townhome venture called Shirley Estates is taking shape, replacing a vacant car lot. Those townhomes are for sale, with prices now starting in the $550,000s.

…

Follow us on social media:

Twitter / Facebook/and now: Instagram

• Hapeville news, discussion (Urbanize Atlanta)

3 neighboring projects spell fresh life for one Hapeville street

Josh Green

Tue, 02/04/2025 – 15:26

A fresh year is bringing new commercial life and construction to one of the main thoroughfares in growing Hapeville. About two blocks from Hapeville’s historic main drag, renovations have wrapped for a new brewery, a new restaurant concept has been confirmed, and the development process has kicked off for nearly 60 new townhomes on consecutive parcels in the 3300 block of Dogwood Drive. The investments continue a years-long growth spurt for the southside ITP city spurred in part by proximity to Atlanta’s airport and the international draw of Porsche’s expanded North American headquarters. First on the docket, a grand opening is planned from 11 a.m. to 11 p.m. Saturday for Columbus-based Chattabrewchee Southern Brewhouse, which is opening a second brewery location in a remodeled building now known as “The Hangar” at 3361 Dogwood Drive. That’s where Arches Brewing operated its taproom for eight years, before uprooting to the Atlanta Utility Works complex in nearby East Point last year.

A work-in-progress wall mural at Chattabrewchee Southern Brewhouse’s The Hangar space. Contributed

Owned by U.S. military veteran and Delta pilot Beau Neal, The Hangar building has incorporated an aviation theme throughout. It falls within Hapeville’s Arts District Overlay and the Urban Village zoning district, which is designed to encourage a more walkable and cohesive environment.“A brewery opening in a renovated former brewery space is quite the turnaround story, given the number of breweries closed in Georgia in 2023 [and] 2024,” noted Brett Reichert, Hapeville City Council member at large, in an email. A recent renovation divided the brewery’s building into three units, and a tapas restaurant is now slated to occupy the middle space, according to Reichert.

Jonathan Joyner Designs/Chattabrewchee Southern Brewhouse

Meanwhile, on an assemblage of seven Dogwood Drive lots immediately north of the brewery, construction is underway on another 58 Hapeville townhomes with walkability to downtown shops and eats. Marietta-based McNeal Development earned city approval last year to construct the townhomes between 3309 and 3345 Dogwood Drive, replacing several older, vacant houses.

Planned three-story facades along Dogwood Drive in Hapeville. The Hartwin Group/McNeal Development

Overview of the 58-unit BTR townhome site plan. The Hartwin Group/McNeal Development; Kimley-Horn

The project is covering about 3 acres total, and each of the townhomes will be Build-to-Rent, instead of being for sale. The least expensive rental option for a two-bedroom unit will be roughly $2,400, according to a presentation by the development team. (The project’s BTR status was a bone of contention among some Hapeville City Council members last spring, requiring Mayor Alan Hallman to break the 2-2 tie.)The townhome project is scheduled to start delivering in early 2026. (Find more images and context here).

The 3335 Dogwood Drive properties in relation to Arches Brewing and other central Hapeville businesses and landmarks. Google Maps

A few blocks north of that project, on the same side of Dogwood Drive, another 28-unit townhome venture called Shirley Estates is taking shape, replacing a vacant car lot. Those townhomes are for sale, with prices now starting in the $550,000s. …Follow us on social media: Twitter / Facebook/and now: Instagram • Hapeville news, discussion (Urbanize Atlanta)

Tags

3335 Dogwood Drive

Hapeville

Dogwood Assemblage LLC

Lowery and Associates

McNeal Development

ITP

Southside

Build to Rent

BRT

Atlanta Townhomes

Hapeville Development

New Townhomes

Hapeville Construction

City of Hapeville

Townhomes for Rent

The Hartwin Group

Kimley-Horn & Associates

Kimley-Horn

Shirley Estates

3361 Dogwood Drive

Chattabrewchee

Jonathan Joyner Designs

The Hangar

Downtown Hapeville

Chattabrewchee Southern Brewhouse

Columbus

Atlanta Breweries

Breweries

Arches Brewing

Subtitle

Brewery, tapas, and nearly 60 new homes on tap near historic downtown commercial hub

Neighborhood

Hapeville

Background Image

Image

Before/After Images

Sponsored Post

Off Read More

3 neighboring projects spell fresh life for one Hapeville street

Josh Green

Tue, 02/04/2025 – 15:26

A fresh year is bringing new commercial life and construction to one of the main thoroughfares in growing Hapeville. About two blocks from Hapeville’s historic main drag, renovations have wrapped for a new brewery, a new restaurant concept has been confirmed, and the development process has kicked off for nearly 60 new townhomes on consecutive parcels in the 3300 block of Dogwood Drive. The investments continue a years-long growth spurt for the southside ITP city spurred in part by proximity to Atlanta’s airport and the international draw of Porsche’s expanded North American headquarters. First on the docket, a grand opening is planned from 11 a.m. to 11 p.m. Saturday for Columbus-based Chattabrewchee Southern Brewhouse, which is opening a second brewery location in a remodeled building now known as “The Hangar” at 3361 Dogwood Drive. That’s where Arches Brewing operated its taproom for eight years, before uprooting to the Atlanta Utility Works complex in nearby East Point last year.

A work-in-progress wall mural at Chattabrewchee Southern Brewhouse’s The Hangar space. Contributed

Owned by U.S. military veteran and Delta pilot Beau Neal, The Hangar building has incorporated an aviation theme throughout. It falls within Hapeville’s Arts District Overlay and the Urban Village zoning district, which is designed to encourage a more walkable and cohesive environment.“A brewery opening in a renovated former brewery space is quite the turnaround story, given the number of breweries closed in Georgia in 2023 [and] 2024,” noted Brett Reichert, Hapeville City Council member at large, in an email. A recent renovation divided the brewery’s building into three units, and a tapas restaurant is now slated to occupy the middle space, according to Reichert.

Jonathan Joyner Designs/Chattabrewchee Southern Brewhouse

Meanwhile, on an assemblage of seven Dogwood Drive lots immediately north of the brewery, construction is underway on another 58 Hapeville townhomes with walkability to downtown shops and eats. Marietta-based McNeal Development earned city approval last year to construct the townhomes between 3309 and 3345 Dogwood Drive, replacing several older, vacant houses.

Planned three-story facades along Dogwood Drive in Hapeville. The Hartwin Group/McNeal Development

Overview of the 58-unit BTR townhome site plan. The Hartwin Group/McNeal Development; Kimley-Horn

The project is covering about 3 acres total, and each of the townhomes will be Build-to-Rent, instead of being for sale. The least expensive rental option for a two-bedroom unit will be roughly $2,400, according to a presentation by the development team. (The project’s BTR status was a bone of contention among some Hapeville City Council members last spring, requiring Mayor Alan Hallman to break the 2-2 tie.)The townhome project is scheduled to start delivering in early 2026. (Find more images and context here).

The 3335 Dogwood Drive properties in relation to Arches Brewing and other central Hapeville businesses and landmarks. Google Maps

A few blocks north of that project, on the same side of Dogwood Drive, another 28-unit townhome venture called Shirley Estates is taking shape, replacing a vacant car lot. Those townhomes are for sale, with prices now starting in the $550,000s. …Follow us on social media: Twitter / Facebook/and now: Instagram • Hapeville news, discussion (Urbanize Atlanta)

Tags

3335 Dogwood Drive

Hapeville

Dogwood Assemblage LLC

Lowery and Associates

McNeal Development

ITP

Southside

Build to Rent

BRT

Atlanta Townhomes

Hapeville Development

New Townhomes

Hapeville Construction

City of Hapeville

Townhomes for Rent

The Hartwin Group

Kimley-Horn & Associates

Kimley-Horn

Shirley Estates

3361 Dogwood Drive

Chattabrewchee

Jonathan Joyner Designs

The Hangar

Downtown Hapeville

Chattabrewchee Southern Brewhouse

Columbus

Atlanta Breweries

Breweries

Arches Brewing

Subtitle

Brewery, tapas, and nearly 60 new homes on tap near historic downtown commercial hub

Neighborhood

Hapeville

Background Image

Image

Before/After Images

Sponsored Post

Off

Prince Hall Masonic Lodge launches $10 million renovation in Sweet Auburn

Prince Hall Masonic Lodge launches $10 million renovation in Sweet Auburn

The building was the headquarters of the Southern Christian Leadership Conference.

The building was the headquarters of the Southern Christian Leadership Conference. Read MoreBizjournals.com Feed (2022-04-02 21:43:57)

The building was the headquarters of the Southern Christian Leadership Conference.

Prince Hall Masonic Lodge launches $10 million renovation in Sweet Auburn

Prince Hall Masonic Lodge launches $10 million renovation in Sweet Auburn

The building was the headquarters of the Southern Christian Leadership Conference.

The building was the headquarters of the Southern Christian Leadership Conference. Read MoreBizjournals.com Feed (2019-09-06 17:16:48)

The building was the headquarters of the Southern Christian Leadership Conference.

Foreclosure auction delayed for Buckhead’s sprawling Piedmont Center

Foreclosure auction delayed for Buckhead’s sprawling Piedmont Center

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale.

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale. Read MoreBizjournals.com Feed (2022-04-02 21:43:57)

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale.

Foreclosure auction delayed for Buckhead’s sprawling Piedmont Center

Foreclosure auction delayed for Buckhead’s sprawling Piedmont Center

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale.

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale. Read MoreBizjournals.com Feed (2019-09-06 17:16:48)

The reason for the delay is unclear, but a real estate observer previously said the lender might be trying to pursue a short sale.